Durante un’operazione di fusione e acquisizione (M&A), avere una piattaforma digitale affidabile e sicura non è solo un vantaggio: spesso fa la differenza tra una transazione efficace e una carica di rischi. In Italia, un’economia dinamica composta da grandi aziende consolidate e nuove startup in crescita richiede soluzioni digitali che possano gestire anche le transazioni più complesse. È qui che entra in scena la Sterling Data Room, una soluzione che si adatta alle particolarità del mercato italiano e offre il supporto ideale per operazioni di M&A. In questa recensione, esploriamo come la Virtual Data Room (VDR) di Sterling risponde alle esigenze specifiche di chi gestisce fusioni e acquisizioni in Italia.

Cos’è una Virtual Data Room?

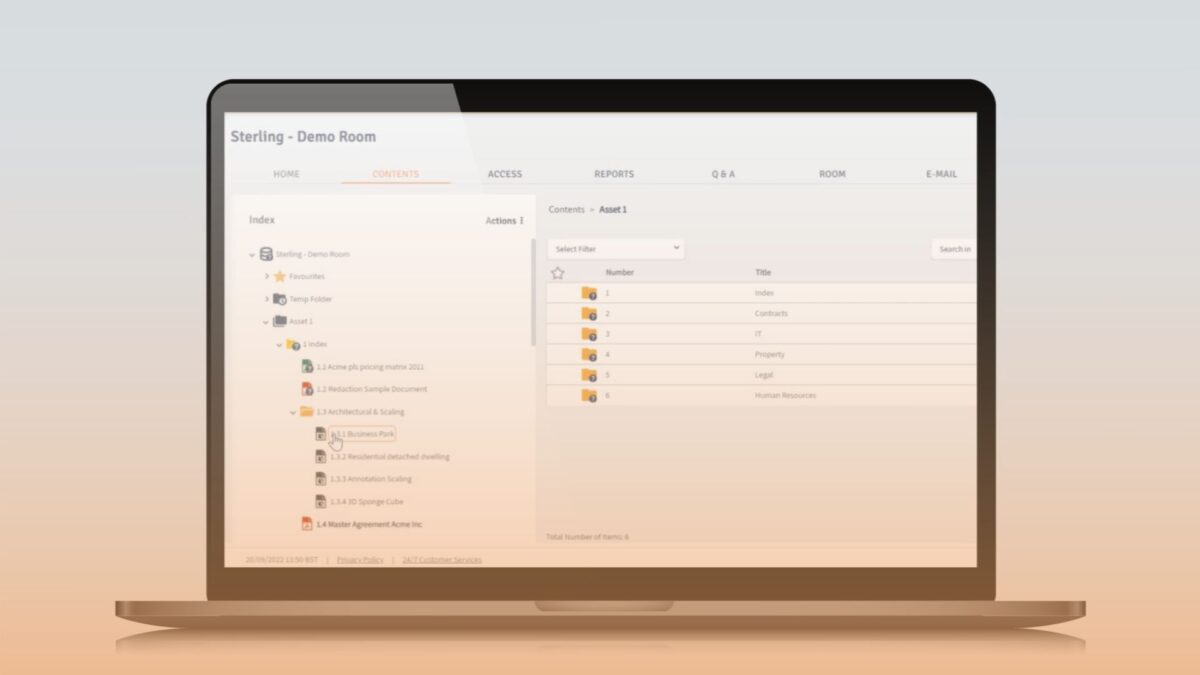

Nel suo nucleo, data room significato si riferisce a un repository online sicuro dove le aziende possono conservare e condividere informazioni riservate, solitamente utilizzato durante transazioni finanziarie, procedimenti legali o in qualsiasi contesto che richieda una gestione di dati sensibili. La VDR di Sterling si distingue per le funzionalità progettate per rendere le transazioni sicure e fluide, rappresentando un asset prezioso nei processi di M&A.

Sterling Data Room: Su Misura per il Mercato Italiano

Caratteristiche Principali e Vantaggi

- Conformità Locale e Sicurezza: Comprendendo le rigorose normative italiane sulla protezione dei dati, la Sterling Data Room garantisce la conformità alle leggi locali, offrendo tranquillità alle aziende che navigano le complessità delle normative italiane ed europee.

- Supporto Linguistico: Con un supporto completo per l’italiano, la Sterling VDR supera le barriere linguistiche, assicurando che tutte le parti possano navigare la piattaforma con facilità, il che è cruciale per favorire fiducia e comprensione in affari multinazionali.

Sterling VDR: Uno Strumento per l’Eccellenza nei M&A Italiani

La Sterling Data Room brilla particolarmente nel contesto delle transazioni di M&A. La sua piattaforma robusta è equipaggiata con funzionalità avanzate per gestire la due diligence, facilitare la revisione dei documenti e semplificare la comunicazione tra le parti.

Data Room M&A: Ottimizzazione delle Transazioni

Per le aziende impegnate in M&A in Italia, l’importanza di una data room specializzata non può essere sopravvalutata. La piattaforma di Sterling offre:

- Gestione Efficiente dei Documenti: Capace di gestire enormi quantità di dati, Sterling consente alle aziende di organizzare i documenti in modo logico, rendendo il processo di due diligence più rapido ed efficiente.

- Protocolli di Sicurezza Avanzati: Assicurare l’integrità dei dati e la riservatezza è critico nelle transazioni di M&A. Sterling impiega crittografia all’avanguardia e misure di sicurezza per proteggere le informazioni sensibili.

Recensione della Sterling Data Room: Perché Scegliere Sterling per le Tue Esigenze di M&A in Italia?

Pro

- Interfaccia User-Friendly: La piattaforma di Sterling è progettata pensando all’utente, garantendo facilità d’uso senza sacrificare funzionalità avanzate.

- Soluzioni Personalizzabili: Riconoscendo che nessuna transazione è uguale all’altra, Sterling offre funzionalità personalizzabili che possono essere adattate per soddisfare le esigenze specifiche di ogni affare.

Contro

- Considerazioni sui Costi: Per le piccole imprese, le funzionalità complete di Sterling possono comportare un costo che necessita di una pianificazione finanziaria accurata.

Esempi Potenziali di Utilizzo della Sterling Data Room

La Sterling Data Room, con le sue robuste caratteristiche progettate per una gestione sicura ed efficiente delle informazioni, può essere utilizzata in una varietà di scenari, specialmente nel contesto italiano. Ecco alcuni esempi potenziali di utilizzo di questo software:

- Fusioni e Acquisizioni (M&A): Le società impegnate in attività di M&A utilizzano la Sterling Data Room per facilitare il processo di due diligence. Funziona come un repository sicuro per tutti i documenti pertinenti, permettendo ai revisori di accedere, valutare e discutere informazioni sensibili in un ambiente controllato.

- Transazioni Immobiliari: Le aziende immobiliari e gli investitori possono sfruttare la Sterling VDR per gestire e condividere documenti critici relativi a vendite di proprietà, locazioni o finanziamenti. La sua piattaforma sicura garantisce che i record finanziari, le valutazioni immobiliari e i documenti legali rimangano riservati e accessibili solo alle parti autorizzate.

- Procedimenti Legali: Studi legali e reparti legali possono utilizzare la Sterling Data Room per condividere prove, fascicoli dei casi e comunicazioni riservate con clienti, altri team legali e stakeholder coinvolti in processi di litigio o arbitrato.

- Raccolta Fondi e Venture Capital: Startup e aziende in cerca di investimenti possono utilizzare la Sterling VDR per condividere i loro piani aziendali, dichiarazioni finanziarie e altri documenti di due diligence con potenziali investitori, società di venture capital e investitori angel in modo sicuro e professionale.

- Farmaceutico e Sanitario: In settori dove la ricerca proprietaria e la riservatezza dei pazienti sono di massima importanza, come nel farmaceutico e sanitario, la Sterling Data Room può essere utilizzata per condividere dati di prove cliniche, risultati di ricerca e presentazioni regolatorie con gli stakeholder garantendo integrità dei dati e conformità alle leggi sulla privacy.

- Joint Venture e Partnership: Le aziende che entrano in joint venture o partnership strategiche possono utilizzare la Sterling Data Room per scambiare documenti aziendali chiave, contratti e piani. Ciò assicura che tutte le parti abbiano accesso alle stesse informazioni, favorendo trasparenza e collaborazione.

- Audit e Conformità: Le organizzazioni sottoposte a audit finanziari o che devono dimostrare conformità normativa possono impiegare la Sterling VDR per condividere in modo sicuro registri finanziari, documenti di conformità e rapporti di audit con revisori e organi regolatori, semplificando il processo di revisione.

Questi esempi illustrano la versatilità e il valore della Sterling Data Room attraverso vari settori e tipi di transazione, in particolare in scenari che richiedono alti livelli di sicurezza, riservatezza ed efficienza nella gestione dei documenti.

Alternative alla Sterling Data Room

Esistono diverse alternative alla Sterling Data Room, utilizzate frequentemente per le operazioni di M&A grazie alle loro caratteristiche mirate. Tra queste, piattaforme come iDeals, Datasite e Intralinks si distinguono per l’attenzione alla sicurezza, la semplicità d’uso e il supporto a processi complessi. Ogni soluzione offre funzionalità specifiche: iDeals, ad esempio, è apprezzata per un’interfaccia intuitiva, mentre Datasite integra strumenti avanzati di analisi e reportistica. Considerare queste opzioni può aiutare a individuare la data room più adatta alle esigenze di una particolare transazione.

Conclusione

Nel mondo delle fusioni e acquisizioni in Italia, la scelta di una virtual data room efficace può davvero segnare la differenza tra un processo semplice e un caos organizzativo. La Sterling Data Room emerge come una soluzione su misura, combinando tecnologia avanzata con una profonda conoscenza delle specificità del mercato italiano. Dalla conformità alle normative locali alla gestione sicura e ordinata dei documenti, Sterling VDR offre un supporto strategico per le aziende che vogliono affrontare le sfide dei M&A con sicurezza e tranquillità.