Nel mondo complesso delle fusioni e acquisizioni (M&A) in Italia, la due diligence diventa non solo una necessità, ma un vantaggio strategico. Di fronte alle complessità uniche del mercato locale, un approccio sistematico alla due diligence aiuta gli imprenditori a mitigare le insidie e rivelare intuizioni nascoste. Questo articolo mira a delineare i punti chiave della due diligence, fornendo informazioni sofisticate e imparziali per l’imprenditore prudente.

Cosa Verificare nella Due Diligence

Comprendere l’approccio strutturato per una due diligence di successo nelle M&A in Italia è cruciale. Ciò include anche un’analisi dettagliata della valutazione dell’azienda, della sua posizione nel mercato e del suo status legale. Un buon esempio di due diligence illumina la via per un’acquisizione redditizia indicando aree di rischio e opportunità.

- Valutazione Aziendale – Valutare la salute finanziaria e la crescita potenziale;

- Posizione di Mercato – Comprendere il panorama competitivo e la quota di mercato;

- Status Legale – Assicurare la conformità con le leggi e i regolamenti locali.

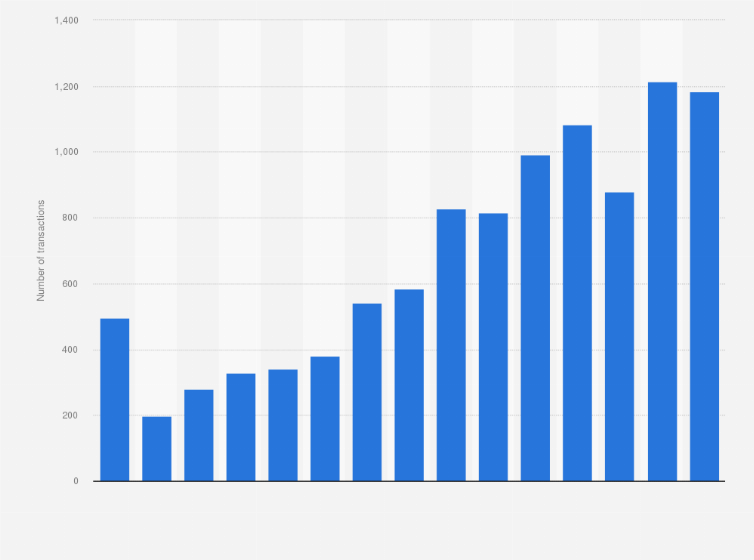

La valutazione di un’azienda in Italia richiede la conoscenza della realtà finanziaria e della crescita potenziale spesso tramite il metodo dell’EBITDA. Ad esempio, il mercato M&A italiano è cresciuto del 30% nel 2021, indicazione della necessità di valutazioni accurate per sfruttare le opportunità di mercato.

La valutazione della posizione di mercato include l’economia altamente diversificata dell’Italia e il vantaggio competitivo, la quota di mercato e la reputazione dell’azienda. Essendo la terza economia più grande della zona euro, l’Italia è un mercato emergente dominato dai leader nei settori della moda, dell’automotive e dell’alimentare e delle bevande. Un’analisi di mercato efficace può illuminare vantaggi competitivi o debolezze.

Padroneggiare la Due Diligence per il Successo nelle M&A in Italia

Navigare le complessità delle Fusioni e Acquisizioni in Italia richiede una solida comprensione delle pratiche di due diligence M&A. Poiché gli investitori o le società aspirano a fondersi o acquisire imprese italiane, devono impegnarsi in una due diligence completa per mitigare i rischi e validare il valore del loro investimento. Sfruttare la due diligence comporta più di una semplice revisione superficiale; richiede un approccio multifaccettato, inclusa la due diligence commerciale per scrutinare la fattibilità commerciale dell’azienda bersaglio. Oltre a questo controllo commerciale, la due diligence legale assicura che tutti i quadri legali siano accuratamente esaminati. La salute finanziaria è fondamentale in questi affari, rendendo la due diligence finanziaria un componente critico per scoprire eventuali preoccupazioni finanziarie sottostanti.

L’integrità e la reputazione delle entità coinvolte non devono essere trascurate; quindi, la due diligence reputazionale valuta la reputazione per prevenire eventuali danni al valore del marchio. Infine, potrebbe essere consultata un’agenzia investigativa per una due diligence investigativa, fornendo uno scrutinio più profondo su eventuali discrepanze o problemi nascosti. Applicando diligentemente questi livelli di analisi, gli stakeholder nel panorama M&A italiano possono prendere decisioni informate, spianando la strada verso una fusione o acquisizione di successo.

Incorporare la Due Diligence Legale, Finanziaria e Reputazionale nella Strategia

Condurre una due diligence completa è imperativo per il successo nelle fusioni e acquisizioni in Italia, poiché garantisce una presa di decisione informata e la mitigazione dei rischi. Incorporare una strategia che unisce in modo fluido la due diligence legale, finanziaria e reputazionale non è solo vantaggioso; è essenziale.

- La due diligence legale è critica per valutare i rischi associati allo stato legale di un’azienda. Esaminando contratti, conformità ai regolamenti estoria litigiosa, questo aspetto della due diligence identifica potenziali insidie legali.

- Allo stesso modo, la due diligence finanziaria esamina in profondità le informazioni aziendali, analizzando salute finanziaria, attivi, passività e tendenze di performance per garantire una comprensione fiscale dell’entità target.

- La due diligence reputazionale spesso comporta l’analisi della percezione pubblica dell’azienda, delle opinioni degli stakeholder e della rappresentazione mediatica per valutare il capitale reputazionale che potrebbe elevare o danneggiare il valore dell’affare.

I professionisti delle M&A che padroneggiano l’arte della due diligence possono trasformare ostacoli potenziali in vantaggi strategici. Questa strategia tripartita non solo assicura una visione olistica dell’obiettivo delle M&A ma rafforza anche il potenziale di successo dell’investimento, allineandosi con le rigorose aspettative normative e di mercato del distintivo panorama aziendale italiano. Incorporando la due diligence in ogni fase del processo, questa meticolosa attenzione ai dettagli offre una protezione sostanziale contro sfide impreviste, garantendo transazioni M&A robuste e redditizie nel mercato italiano.

Quadro Legale e Dominio della Conformità

In Italia, una revisione completa di tutti i documenti legali pertinenti è cruciale per assicurare la conformità e proteggere i diritti di proprietà intellettuale. Ciò include un’analisi approfondita della politica degli IDE in Italia, comprendendo il quadro legale che circonda gli investimenti diretti esteri e salvaguardando le innovazioni attraverso la gestione della proprietà intellettuale.

- Documenti Legali: Revisione di contratti, accordi e documenti di conformità.

- Proprietà Intellettuale: Protezione di brevetti, marchi e diritti d’autore.

- Politica degli IDE: Navigazione delle normative che governano gli investimenti esteri in Italia.

Navigare il sistema legale italiano richiede una strategia dettagliata per garantire che ogni area di conformità e protezione della proprietà intellettuale sia considerata. Ciò implica comprendere le complessità della politica degli IDE in Italia e come essa influenzi gli investimenti esteri. Attraverso una revisione dettagliata dei documenti legali e l’osservanza dei diritti di proprietà intellettuale, le aziende possono preservare la loro innovatività e allo stesso tempo conformarsi alle linee guida normative, rendendo così il processo di M&A fluido.

Rivoluzionare la Due Diligence M&A con Strumenti Digitali

L’era digitale ha apportato molti cambiamenti alla due diligence M&A, uno dei quali è l’automazione del processo che migliora sia la velocità che la sicurezza. Ad esempio, una data room virtuale multipartner consente agli stakeholder di lavorare come un’unica unità, fornendo una piattaforma sicura da cui possono condividere informazioni sensibili. Questo approccio digitalizzato non solo accelera il processo ma migliora anche l’accuratezza e la trasparenza.

- Condivisione Sicura: Salvaguardia delle informazioni riservate garantendo l’accesso agli utenti autorizzati.

- Efficienza: Razionalizzazione del processo di due diligence per accelerare la presa di decisioni.

- Collaborazione: Abilitazione della comunicazione tra vari stakeholder.

L’uso della data room per la due diligence in Italia è aumentato di oltre il 40% nel 2020, indicando il loro ruolo crescente nel consentire affari efficaci e sicuri. Il passaggio alla digitalizzazione migliora i processi di due diligence e favorisce un approccio calibrato dove le parti da varie località possono svolgere un ruolo efficace nella transazione.

Approcci Strategici alle Sfide della Due Diligence

Affrontare gli aspetti finanziari della due diligence comporta una revisione meticolosa delle proiezioni finanziarie, dei contratti e delle polizze assicurative. Inoltre, una valutazione critica delle tasse e del loro impatto potenziale sull’investimento è essenziale. Questo approccio strategico garantisce una comprensione completa della salute finanziaria e dei rischi associati alla transazione M&A.

- Proiezioni Finanziarie: Analisi dei guadagni futuri e del potenziale di crescita;

- Contratti: Revisione degli accordi per passività o rischi potenziali;

- Assicurazioni: Verifica della copertura adeguata e valutazione della gestione dei rischi;

- Tasse: Comprensione delle implicazioni fiscali e delle possibili passività.

La due diligence finanziaria è essenziale nell’ambiente fiscale complesso dell’Italia per le operazioni di M&A. Il sistema fiscale stratificato del paese richiede un’analisi dettagliata per scoprire le passività e ottimizzare le configurazioni fiscali. Il regime del patent box del 2015, che offre agevolazioni fiscali per gli investimenti in R&D, influisce notevolmente sulle valutazioni delle aziende tecnologiche nelle M&A. Comprendere questi dettagli è fondamentale per valutazioni finanziarie precise, valutazioni dei contratti e per assicurare che le polizze assicurative affrontino i rischi della transazione.

Conclusione

L’importanza della due diligence completa per il successo nelle fusioni e acquisizioni non può essere sopravvalutata. Quando un imprenditore, nuovo nel settore, sfrutta strumenti innovativi e affronta le complessità del mercato italiano con competenza, aumenta significativamente le sue possibilità di concludere un affare di successo. Nel contesto del panorama M&A italiano, la due diligence va oltre la semplice mitigazione dei rischi; rivela anche nuove opportunità di crescita e successo.